I am nominating Slosh for "Economic Input of the Year."

I'm talking about the huge tides of wealth that have flowed back and forth between the U.S. dollar and euro over the past few months.

Here's how I put it in a recent issue of Blue Chip Trader:

Picture your kid in the bath. What happens when they scoot wildly from one end to the other looking to escape the dreaded soapy washcloth? The restricted space creates a miniature tidal wave that ends up sending water up their nose and soaking your shirt.

One moment, it looks like the Euro is going to vanish right here and now, forcing anyone doing biz on the continent desperately seeking dollars. It's not that they love the dollar. They just need practical liquidity.

The next day, the sun rises on Paris and Berlin, and lo and behold: the Eurozone is still in business, the Euro is still coin of the realm, and traders and business men of all stripes have to go out and get some if they want to biz that day.

Advertisement

TONIGHT: Free Video Seminar with Gold Guru

This high-profile gold investor led investors to astounding gold-stock gains like 1,235% on Capital Gold, 893% on Allied Nevada, and 792% on Fortuna Silver...

Tonight, Greg McCoach will share his top gold investment ideas in a FREE internet video investment conference, called "The Yukon's Best: The Easiest Gold Gains You'll Ever Make."

Enter your email address in the form found here and join Greg tonight at 6 p.m. EST for this groundbreaking investment conference.

Nailing the Lid on the CoffinIt kinda sucks to be a generic "European" right now.

Over the past few days, we have seen reports of:

- The European Central Bank has cut its 2012 euro-area growth forecast this month to 0.3%.

- European industrial production declined 0.1% in October.

- British unemployment is hitting a 17-year high.

- The next EC Composite PMI Output index of euro-area manufacturing and services activity is slated to fall to from November's 47 to 46.5 in December.

- The Kiel-based IfW institute forecast growth will slow from 2011's 2.9% to 0.5% in 2012.

- Essen's RWI predicts that European expansion will decelerate from 3% to 0.6%.

- And Sweden’s central bank has cut its main interest rate for the first time since 2009, signaling it may keep the benchmark unchanged over the next year.

I could go on ad nauseam, but I think you get the picture.

Strangely enough, German confidence is actually up.

Or Just Maybe, Steps on a Ladder?

The Ifo institute’s business climate index survey of 7,000 German executives beat guesstimates of a drop to 106, climbing instead from 106.6 in November to a current reading of 107.2.

And market researcher GfK SE claims consumer confidence will hold its gains in January as German unemployment hits a two-decade low.

The gestalt here?

I guess it's that old Nietzschean "What doesn't kill us makes us stronger" ethic.

German players are talking about “weathering the storm” with industry-friendly wage agreements and full order books.

Advertisement

PROVEN: Three-year test delivers 68% every three weeks.

Thousands of investors have discovered easy gains with this guaranteed system.

It's time you became one of them.

Feeding the Short-term Need

If there is to be biz come the morning, the Germans will need an ample supply of currency to feed the need.

And since there is still no Neu-Mark yet, that means that we are sloshing once again from dollars to euros.

As I sit to write to you, the dollar is plummeting compared to the usual basket of global currencies.

Now, let's be honest with ourselves...

So far, this is just a cyclic downturn within the context of a rising trend — in other words, slosh — rather than a genuine dollar downturn.

Eventually, we will have to see if this thing has real legs or not.

But for now, this is a broad rising trend — and this particular cyclic downturn could very well see the dollar lose some 5%, much as it did back in October.

Following the Golden Thread

Now let's take things another step: quite a few assets are doled out in dollars (stuff like oil and gold in particular).

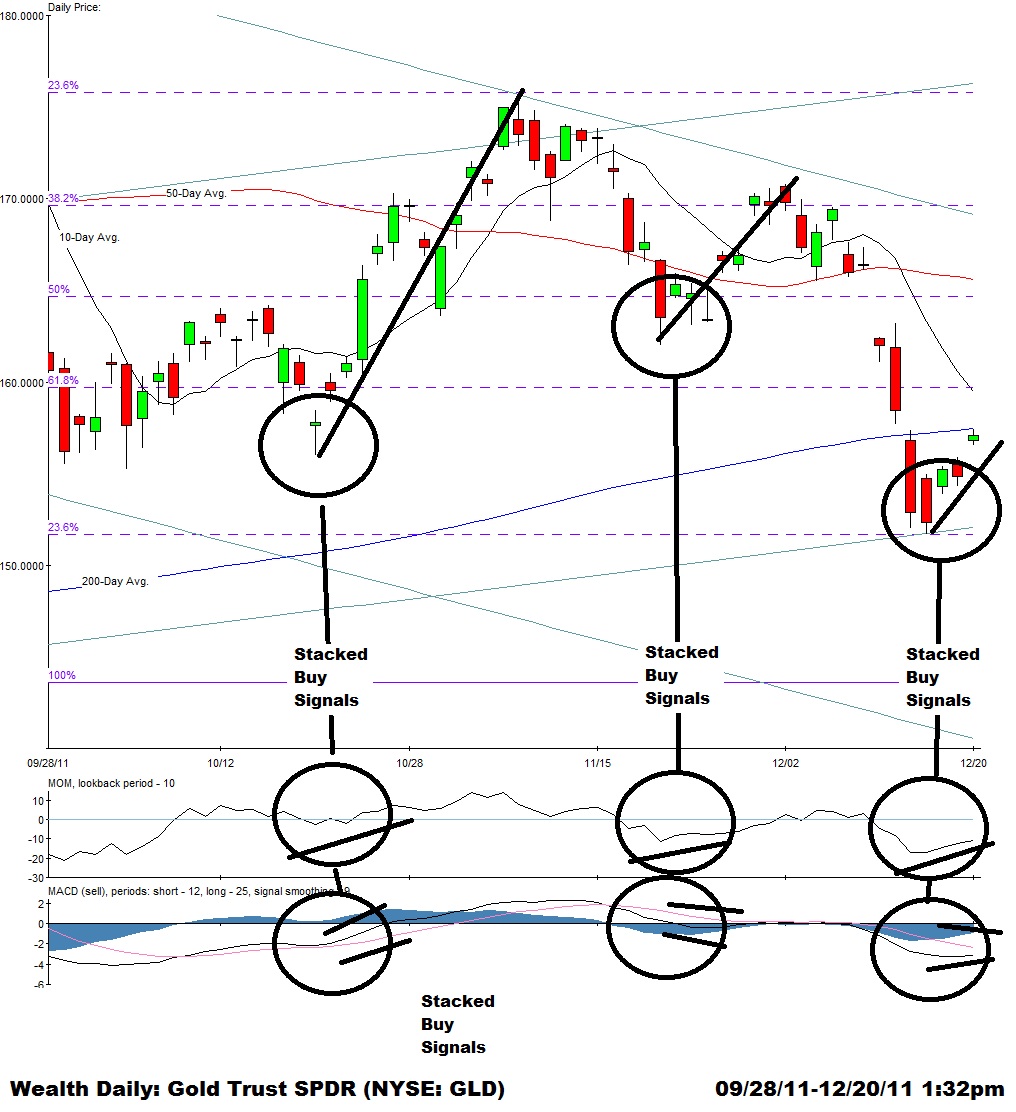

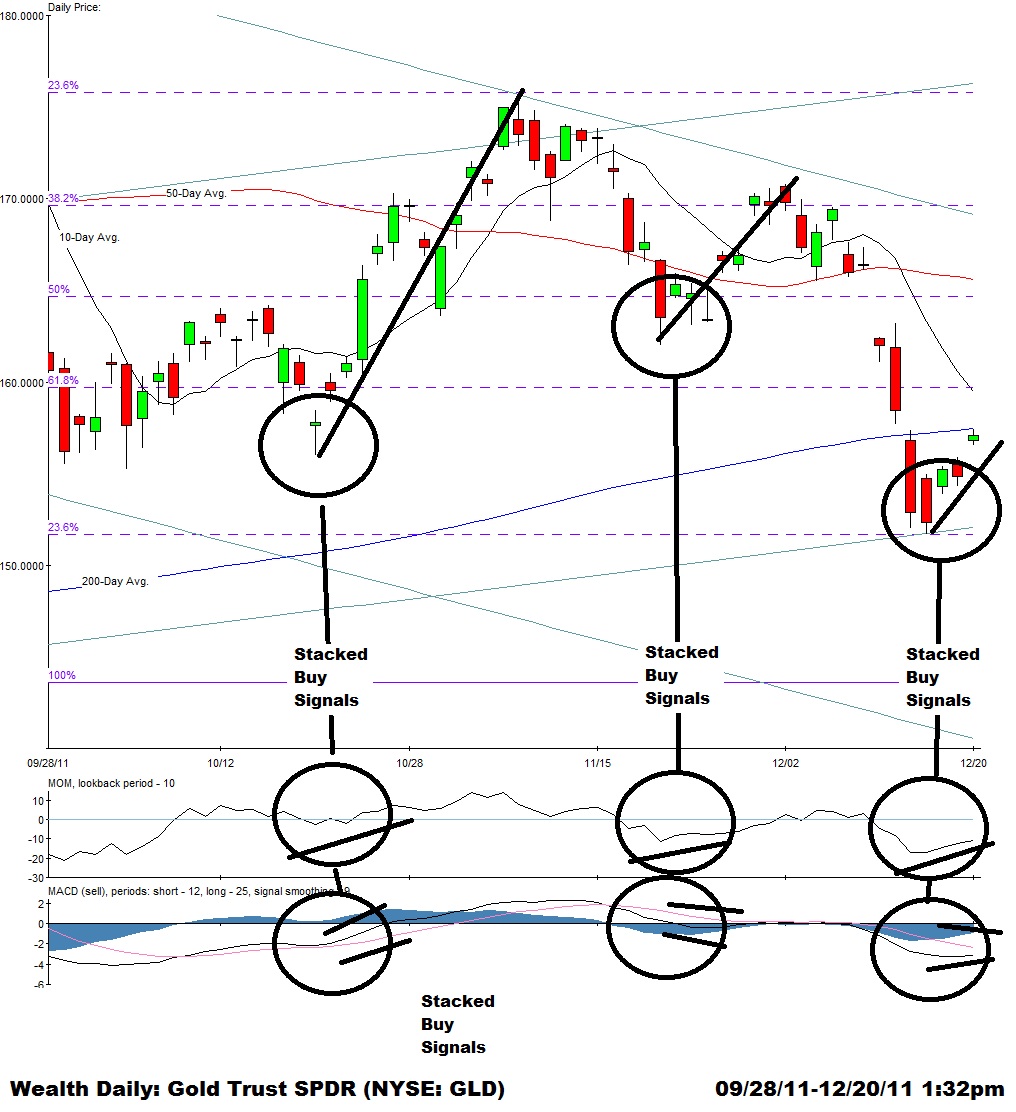

When we look to the charts for the Gold Trust SPDR (NYSE: GLD), the ETF that follows gold, we see the same slosh — with the GLD rising and falling contrapuntally to the dollar's stumbles and spikes.

When we look to the charts for the Gold Trust SPDR (NYSE: GLD), the ETF that follows gold, we see the same slosh — with the GLD rising and falling contrapuntally to the dollar's stumbles and spikes.

This not the value argument you might think...

Simply put, gold and the GLD are measured in dollars.

So when the dollar sinks, it requires more dollars to buy the same gold.

Okay, maybe there IS a value argument in here somewhere. I could easily claim gold is rising long term.

If this is indeed a true reversal in gold's resent slide, you would see GLD return to its September high of $185, which would make for gains of 17% just for the STOCK.

280% Bucket of Slosh

But I don't care about value philosophy right now.

I'm making a chart argument today, and the chart for GLD is showing matching short-term cyclic buy signals to the dollar's sell signals.

Right now, I think I can promise you a rise in GLD anywhere from 5% to 12%.

That first target ought to push mid-dated at-the-money GLD calls up some 78%.

Considering the ever-changing state of "slosh" these days, you probably ought to settle for that...

But for those of you who like play in rough seas for fun and sport, a 12% rise in GLD would push that gain to 180%.

And that genuine breakout I mentioned? It would push call gains to 280%.

Good luck and good hunting,

Adam Lass

@AdamLass1 on Twitter

@AdamLass1 on Twitter

Adam Lass is the editor of Blue Chip Trader and a regular contributor to Wealth Daily on Wall Street and Washington's little frauds. He has been in the business for almost 20 years, and has writen for several well-known newsletters, including Fleet Street (U.S.), Hard Assets, and Taipan. He is very proud of being kicked off CNBC's Squawk Box back in 2007 for warning the audience of a total market breakdown. Sometimes, the truth hurts! For more on Adam, go to his editor's page.

@AdamLass1 on Twitter

@AdamLass1 on Twitter

No comments:

Post a Comment